Contents

The indices movements are the net gain/loss of the stock market as a whole. If the NFP has buyers buying or sellers selling you will see it in the index charts. A strong NFP number can help confirm trends and pinpoint key turning points in bear markets. Likewise, weak or weakening NFP, especially with slowing wages or wage declines, would help confirm bear markets and changes in bull market conditions. If underlying core inflation, as read by the PCE price index, is running tame it may not matter if hourly wages are running hot.

The other method of trading the NFP is the short-term news; is the NFP better or worse than expected, or does it confirm or refute market expectations. The problem with this method is that the NFP doesn’t always get the market wound up enough to produce a move and, because of its flaws, rarely produces a figure that is truly market moving. The two biggest problems faced by the FOMC, relative to the NFP, is if wages are rising too fast and if wages are shrinking.

Additionally, the margin of error is often larger than the actual number. At any given time, on any given release, the Non-Farm Payrolls figure you see in the headline is affected by such a large margin of error it is near meaningless without context. Because of these complications, the BLS omits farmers from its national employment figures. Instead, farming employment statistics are tracked by the Department of Agriculture.

The gap between the actual https://bigbostrade.com/ for non-farm statistics and the figures that economists expect to see will frequently decide the overall impact on the market. Should the unemployment rate decrease from one month to the next, this job growth makes the market undergo a consumption improvement. The initial value for the key indicator is typically released on the first Friday of each month – along with any revision to the previous month’s data and the U.S.

The monthly nonfarm payroll report from the BLS can have a substantial impact on foreign exchange markets when the numbers are released on the first Friday morning of a new month. For Instance, the employment report released at the end of every month by the Bureau of Labor Statistics contains; unemployment data, job growth stats, and payroll data, among other key statistics. This data is what economists use to determine the health of the economy, and that’s why everyone who trades forex must always monitor this info. Every forex trading broker and trader must acknowledge and scrutinize this data because it provides a footing for predicting potential inflation or economic growth rates. An expected change in payroll figures causes a mixed reaction in the currency markets.

The value of a currency on the foreign exchange market is hugely influenced by signs of a nation’s economy becoming stronger or weaker. As a result, the US’s nonfarm payroll report consistently causes some of the largest movements in the FX market. In the US, consumer spending accounts for almost two-thirds of the GDP. For currency traders worldwide, non-farm payrolls are a critical economic indicator. Investors and Forex traders anxiously await the NFP report from the Bureau of Labor Statistics .

Open a live account and start trading on one of the most transparent

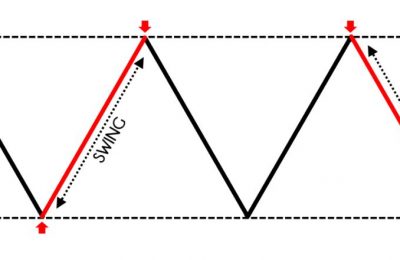

This inside bar’s high and low rates set up your potential trade triggers. When a subsequent bar closes above or below the inside bar, market participants take a trade in the direction of the breakout. They can also enter a trade as soon as the bar moves past the high or low without waiting for the bar to close.

- Companies don’t start new projects and government doesn’t have the money to pay their employees.

- If the NFP is trending strongly it is a sign of underlying economic strength and consumer health.

- Forex trading conditions may get distorted in the days before the publication due to the competition for positioning heading into the figure.

This results in EU spending less than they used to, for imports from the US as lesser Euros are needed to buy more of USD. Access our latest analysis and market news and stay ahead of the markets when it comes to trading. Find out which account type suits your trading style and create account in under 5 minutes.

In Inflationary Times

The United States Non-Farm Payroll data is the most-anticipated economic news reports in any particular month. Like many other economists, the economists making monetary policy decisions for the U.S. When released, the NFP data covers the net number of non farm jobs added or subtracted during the previous month. The changes seen in the NFP number can have a significant effect on the U.S. economy.

The ADP Report is a private-sector gauge of labor market trends akin to the NFP. The ADP and NFP are frequently out of alignment on their gauge of monthly job gains but tend to track alongside each other over time. The NFP can have an impact on individual stocks and that effect is best seen in the indices.

The stop loss should be placed just the other side of the reversal candlestick pattern. Countries that trade heavily with the United States tend to be more affected by the NFP than those which do not, as the NFP in Forex can dictate monetary flow going forward. Commodity currencies tend to be relatively sensitive to the NFP data, because of the crude oil and other commodity demands that could come from a strong labor force in the United States. To take advantage of short-term expectations, an investor needs a detailed understanding of the long-term price trend and why the current NFP data is more or less significant than previous NFP reports. The best indications are confirmed expectations and changes in trends. Overall, significant volatility in gold is anticipated today, depending on the NFP report’s results.

US jobs report pre-release checklist – February 2nd, 2022

An https://forexarticles.net/ in user spending has always been a factor behind USD performance, even if its impact is often understated. For this reason, job gains can definitely affect nonfarm payroll forex trading. Non-Farm Payroll is more important for entrepreneurs and long-term investors and swing traders who hold their positions sometimes for years. It gives them a long-term perspective about economy and main direction of the Forex and other markets.

They can offer guidance and financial solutions to mitigate the risk of market fluctuations affecting your money. Furthermore, as well as showing the total number of nonfarm payroll employees, it also shows the number of new nonfarm payroll jobs added within the US’s economy. It weakened the dollar’s position against other currencies as the lower-than-expected data hinted at slow US economic growth. Traders may have used this as a reason to sell their dollars in favour of other currencies – thus decreasing the dollar’s value. In the United States, the number of workers in the country is measured through nonfarm payrolls.

This can make trading difficult, even once a few minutes have passed following the announcement. The non-farm payrolls announcement can be tricky to interpret because it must be looked at through the prism of what the market is most focused on at the time. The GBPUSD is the favoured pair for this approach because it typically moves more than the EURUSD.

When more people are working, when wages are rising, when employees are confident, and labor markets are tight the consumer if flush with money. When the consumer is flush with money, it is more comfortable spending on things it needs, services it likes, luxuries it can’t resist, and that fuels the broader economy. The NFP usually has most effect on USD currency pairs such as EUR/USD, but other pairs may be more strongly affected by the data release. When forex traders prepare to release NFP data, they consult economic calendars. Non-Farm Payrolls are one of the key indicators of US economic health. The figure represents the number of jobs added, excluding farm employment, government employees, private household employees, and employees of nonprofit organizations.

Let’s talk currency

https://forex-world.net/ day traders wait to see what currency traders are going to do before establishing their positions and making trades. If currency traders begin buying dollars, day traders begin to take long positions. If the currency traders buy euros, day traders begin to take short positions.

The difference between your stop loss and entry is your ‘trade risk’ in pips. The difference between your profit target and the entry point is your ‘profit potential’ in pips. Once the initial large move occurs, there is usually a price pullback that signals an entry point. Using one-minute price bars, traders draw a trendline from the high of the initial move to the high of the price pullback one-minute bars .

Should the NFP report show a decline below 100,000 jobs (or a less-than-estimated print), it’s a good sign the U.S. economy isn’t growing. As a result, Forex traders will favour higher-yielding currencies against the U.S. dollar. If you want to know more about trading the news and data releases, see our trading the news beginner guide.

Investors must consider the risks involved and use effective significant risk management to safeguard their positions from irrational loss due to the high level of market volatility. The USD often appreciates as the NFP report’s unemployment rate declines. One well-known economic data indicated that affects gold volatility is the Non-Farm Payroll report. Depending on the results of this research, the direction of the XAUUSD’s movements will change.

This difference between the two can help advanced traders and attentive forex traders anticipate the significance of the movement following the NFP release. Accordingly, several possible incidents can follow NFP’s all-important news release. As a trader, it’s crucial to evaluate the following scenarios in the provided economic data. In the United States, the highly influential Non Farm Payrolls data is usually expressed on a monthly basis in terms of the number of people added or subtracted from those employed in non farm related jobs.

In that scenario, it does make sense that a strong jobs market points towards the US Dollar strengthening due to tightening monetary policy. However, under normal circumstances the exact opposite could also be true because of the demand equation concerning foreign goods imported into the US for consumption and business use. The foreign exchange market is influenced by a countless number of factors. Everything from central bank speeches to world-changing black swan events can have an impact on the world’s currencies. The NFP report typically impacts all significant currency pairs, but the GBP/USD is among the most popular traders.

This is an important message to entrepreneurs and investors, both in the United States and outside of this country. It gives them more enthusiasm and interest in working and investing in the United States because they see that the conditions are good and are getting better to invest and work and make profit. To do this, they must buy USD against other currencies, especially those who are outside of the United Stated and want to invest and start working in this country. As a result, the USD’s value goes higher against other currencies because there is more demand for it.

20 comments on “How Does Non Farm Payroll Affect Forex”

Pingback:

สล็อตค่ายใหญ่Pingback:

ที่พักพูลวิลล่าพัทยาPingback:

https://stealthex.ioPingback:

candy burstPingback:

luckyvip77Pingback:

บับเบิ้ลกันกระแทกPingback:

รับสร้างบ้านPingback:

Stripchat promoPingback:

พิมพ์การ์ดแต่งงานPingback:

my camPingback:

apk mostbetPingback:

รีวิวเกมสล็อต ค่าย PG SLOTPingback:

MelissaPingback:

lekded987Pingback:

คลินิกจัดฟัน ฉะเชิงเทราPingback:

pg168Pingback:

รวย168 สล็อตเว็บตรงPingback:

ปลูกผมPingback:

พลาสติกปูพื้นก่อนเทคอนกรีตPingback:

UV LED LAMP